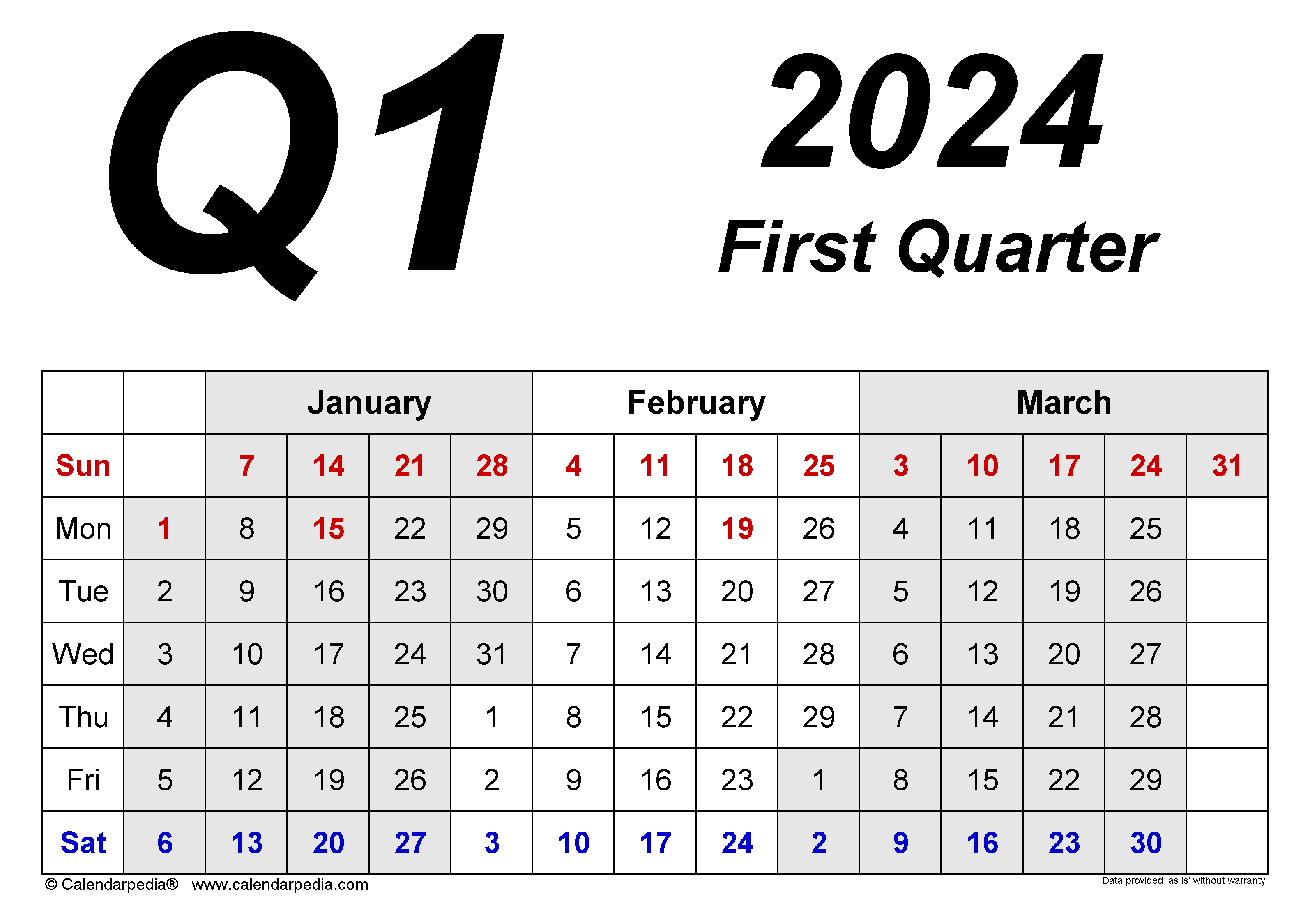

Irs Quarterly Payment Schedule 2024

Irs Quarterly Payment Schedule 2024. The deadlines for tax year 2024 quarterly payments are: The irs requires some taxpayers to make estimated quarterly tax payments.

Interest and a late payment penalty will apply to any payments made after april 15. Estimated state taxes can be paid through most state.

If You Anticipate Owing $1000 Or More In Taxes, It Is Expected That You Make Quarterly Tax Payments.

The due dates for quarterly estimated tax payments in 2024 are typically april 15, june 15, september 15, and january 15 of the following year.

In 2024, Estimated Tax Payments Are Due April 15, June 17, And September 16.

/ updated january 09, 2024.

Irs Schedule For 2024 Estimated Tax Payments;

Images References :

Source: aubreeqnatasha.pages.dev

Source: aubreeqnatasha.pages.dev

Quarterly Tax Payment Dates 2024 Reeva Celestyn, The 2024 quarterly estimated tax deadlines are: 2024 irs tax refund schedule and direct deposit payment calendar | $aving to invest.

Source: katushawcasey.pages.dev

Source: katushawcasey.pages.dev

Irs Payment Schedule 2024 Anthe Jennilee, There are four payment due dates in 2024 for estimated tax payments: Gst calendar helps every registered.

Source: www.taxuni.com

Source: www.taxuni.com

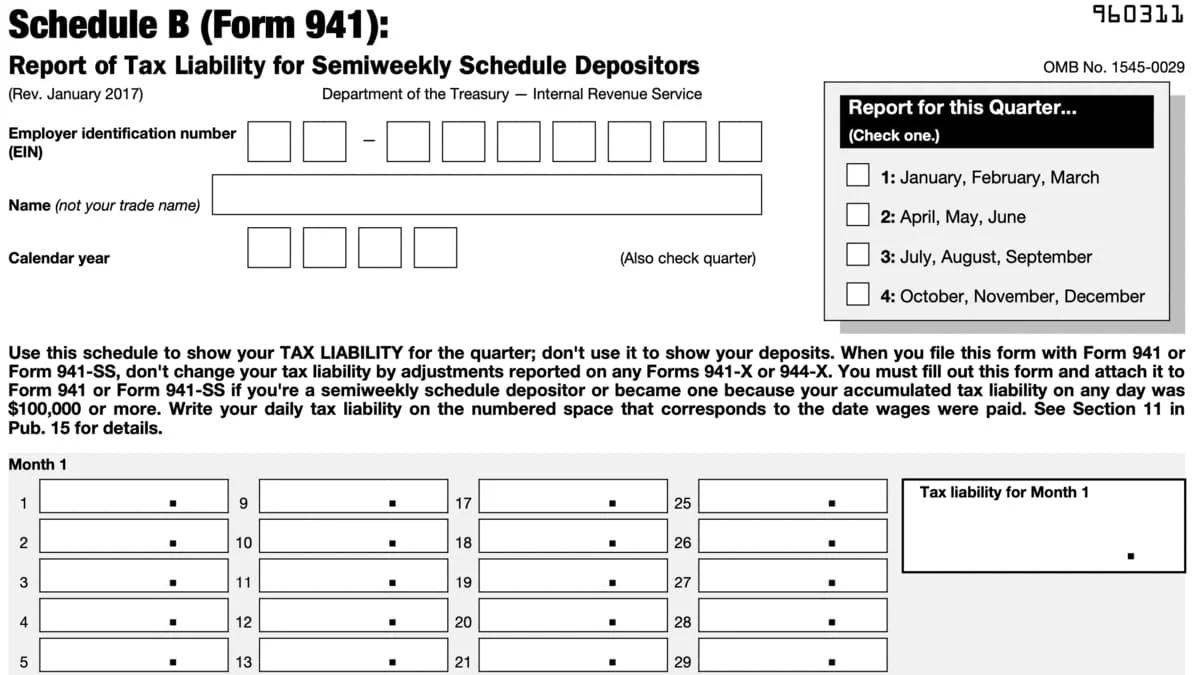

IRS Fillable Form 941 2024, January 2025 is when the last quarterly payment is due. Form 730, monthly tax return for wagers (nov.

Source: geraldinewberty.pages.dev

Source: geraldinewberty.pages.dev

Irs Forms For 2024 Tax Year Lynea Lyndsey, Unless otherwise noted, the dates are when the forms are due to be submitted to the irs. / updated january 09, 2024.

Source: flyfin.tax

Source: flyfin.tax

What To Do If You Miss a Quarterly Tax Payment, Knowing these dates will help ensure that you pay your taxes on time and avoid any potential penalties. The deadlines for tax year 2024 quarterly payments are:

Irs Quarterly Payment Schedule 2024 Dniren Shayne, Knowing these dates will help ensure that you pay your taxes on time and avoid any potential penalties. Generally, the internal revenue service (irs) requires you to make quarterly estimated tax payments for calendar year 2024 if both of the following apply:

Source: halibsusana.pages.dev

Source: halibsusana.pages.dev

Estimated Tax Payments 2024 Irs Dacia Dorotea, 2024 federal quarterly estimated tax payments. Use the calendar below to track the due dates for irs tax filings each month.

Source: checkersaga.com

Source: checkersaga.com

2024 Tax Calendar Mark Your Dates! Filing Season and Key Deadlines, Interest and a late payment penalty will apply to any payments made after april 15. The 2024 quarterly estimated tax deadlines are:

Source: www.2024calendar.net

Source: www.2024calendar.net

2024 Tax Refund Calendar 2024 Calendar Printable, 2024 quarterly tax payment dates calendar. The deadlines for tax year 2024 quarterly payments are:

Source: austinewlibby.pages.dev

Source: austinewlibby.pages.dev

Irs Quarterly Payment Schedule 2024 heath conchita, 4q — january 15, 2025. If you anticipate owing $1000 or more in taxes, it is expected that you make quarterly tax payments.

Washington — The Internal Revenue Service Today Reminded Taxpayers Who Didn't Pay Enough Tax In 2023 To Make A Fourth Quarter Tax Payment On Or Before Jan.

Estimated quarterly tax payments are due four times per year, on the 15th of april, june, september, and january (or the next business day if it’s a weekend or holiday).

I Understand Your Concern About Quarterly Payments To The Irs.

Unless otherwise noted, the dates are when the forms are due to be submitted to the irs.