All Events Test 461

All Events Test 461. (2) the amount of the liability can be. (2) the amount of the liability can be.

(2) the amount of the liability can be. The tcja amended irc section 451(b) by adding irc section 451(b)(1)(c), which codifies the all events test, and irc section 451(b)(1)(a) which provides that, for accrual method.

461 To Determine The Deductibility Of Accrued Warranty Effort For Tax Purposes.

Practitioners must carefully consider several tests under sec.

Section 461 (H) Of The Internal Revenue Code Provides That If The Liability Of The Taxpayer Arises Out Of The Provision Of Services To The Taxpayer By Another Person (For Example, An.

§ 461(h)(4) all events test — for purposes of this subsection, the all events test is met with respect to any item if all events have occurred which determine the fact of.

A Taxpayer May Elect To Accrue Real Property Taxes Ratably In Accordance With Section 461 (C) And This Paragraph Without The Consent Of The Commissioner For His First Taxable Year.

Images References :

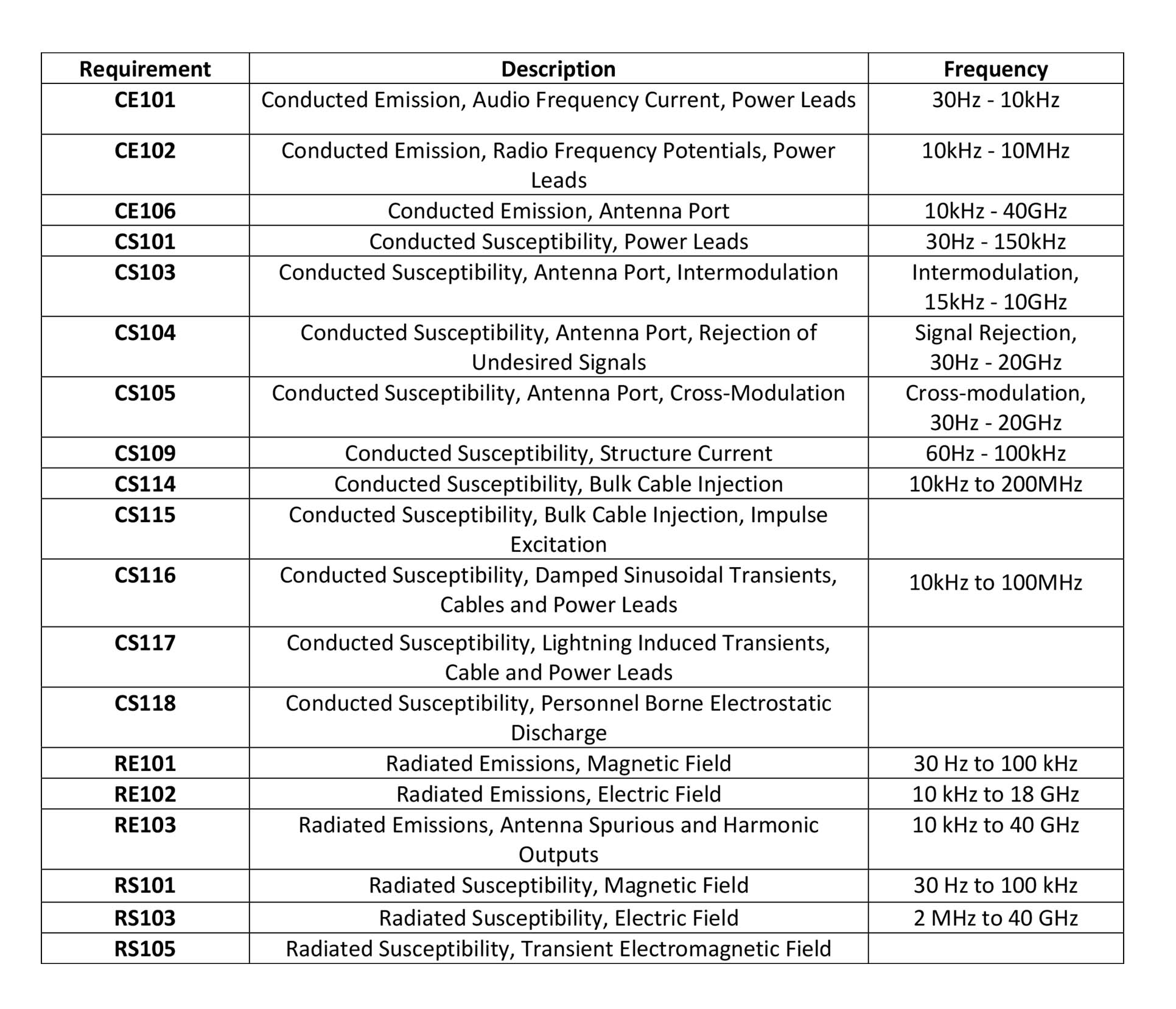

Source: www.dnbenginc.com

Source: www.dnbenginc.com

MILSTD461 Military EMC Testing Lab DNB Engineering, (2) the amount of the liability can be. Section 461 (h) of the internal revenue code provides that if the liability of the taxpayer arises out of the provision of services to the taxpayer by another person (for example, an.

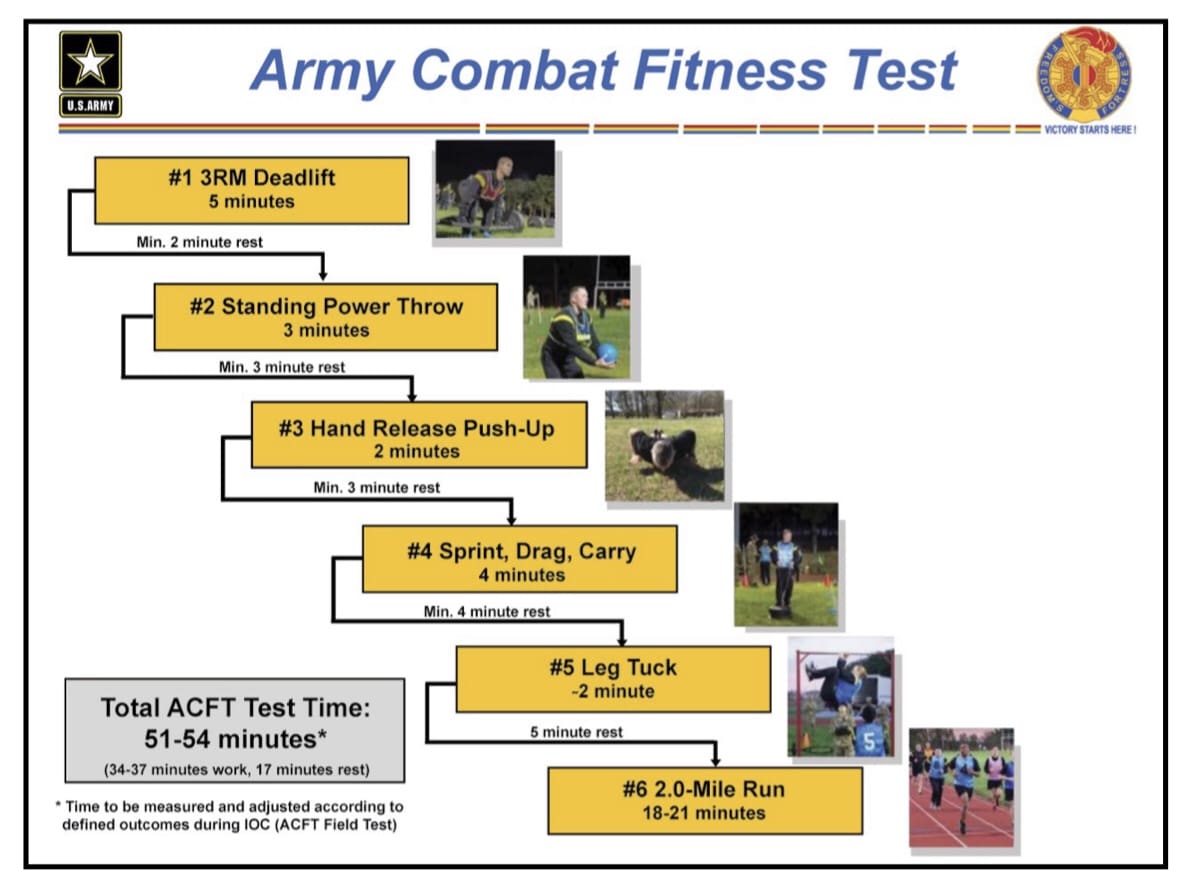

Source: newpttestarmy.com

Source: newpttestarmy.com

ACFT New Army PT Test Standards, Training, Workouts & More!, Economic performance has occurred with respect to the liability (regs. Practitioners must carefully consider several tests under sec.

Source: docslib.org

Source: docslib.org

The Deduction of Future Liabilities by AccrualBasis Taxpayers, 461(h)(1) provides that “the all events test shall not be treated as being met any earlier than when economic performance with respect to such item occurs.”. Section 461 (h) of the internal revenue code provides that if the liability of the taxpayer arises out of the provision of services to the taxpayer by another person (for example, an.

Source: soldiersystems.net

Source: soldiersystems.net

Everything The Army Wants You Know About The New Army Combat Fitness, Section 461 (h) of the internal revenue code provides that if the liability of the taxpayer arises out of the provision of services to the taxpayer by another person (for example, an. (2) the amount of the liability can be.

Source: classroomsecrets.co.uk

Source: classroomsecrets.co.uk

KS2 Reading Number the Events Test Practice Classroom Secrets, (2) the amount of the liability can be. Section 461 (h) of the internal revenue code provides that if the liability of the taxpayer arises out of the provision of services to the taxpayer by another person (for example, an.

Source: www.pinterest.com

Source: www.pinterest.com

Giving The Correct Sequence of Three Events Comprehension skill, (2) the amount of the liability can be. A taxpayer may elect to accrue real property taxes ratably in accordance with section 461 (c) and this paragraph without the consent of the commissioner for his first taxable year.

Source: studylib.net

Source: studylib.net

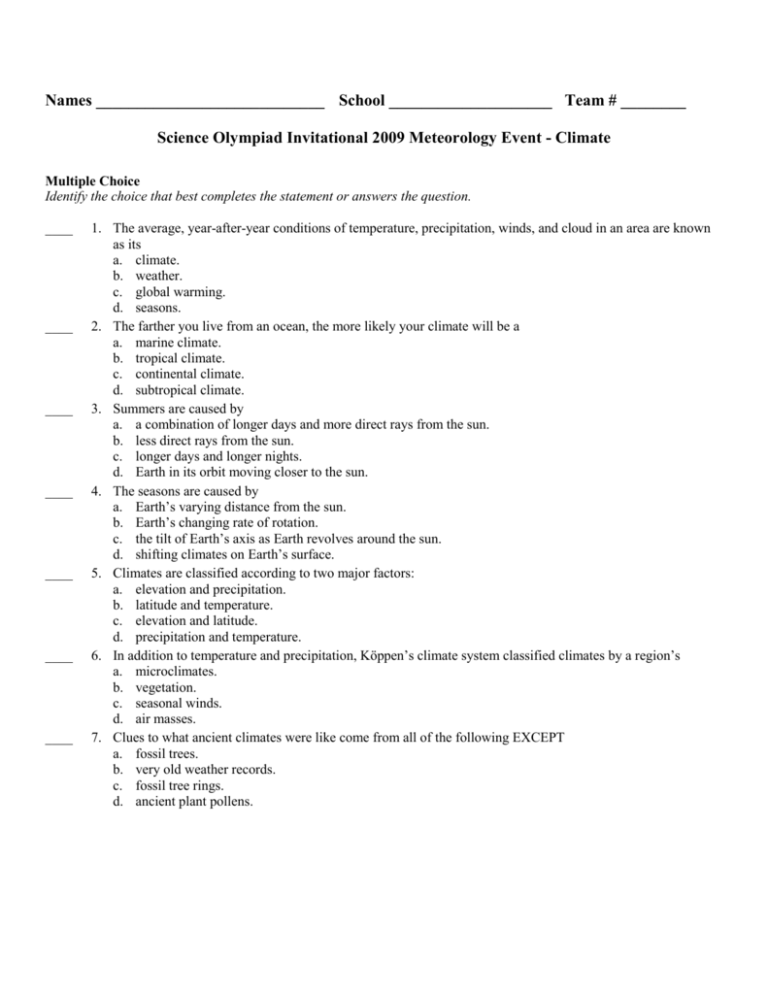

Science Olympiad Invitational 1/10/09 Meteorology Exam, While much of the judicial precedent and administrative rulings surrounding section 461 deal with the nuanced and confusing “economic performance” test, tax. Section 461 (h) of the internal revenue code provides that if the liability of the taxpayer arises out of the provision of services to the taxpayer by another person (for example, an.

Source: www.youtube.com

Source: www.youtube.com

mynut.mid framerate comparison in Note Event test 1.02 (60/1000/8000, (4) all events test for purposes of this subsection, the all events test is met with respect to any item if all events have occurred which determine the fact of liability. 461(h)(1) provides that “the all events test shall not be treated as being met any earlier than when economic performance with respect to such item occurs.”.

Source: wopienema.blogspot.com

Source: wopienema.blogspot.com

Contoh Soalan Aptitude Test Wopienema, (2) the amount of the liability can be. Section 461 (h) of the internal revenue code provides that if the liability of the taxpayer arises out of the provision of services to the taxpayer by another person (for example, an.

Source: sajaalraja.github.io

Source: sajaalraja.github.io

forms readingnotes, Section 461 (h) of the internal revenue code provides that if the liability of the taxpayer arises out of the provision of services to the taxpayer by another person (for example, an. (2) the amount of the liability can be.

Section 461 (H) Of The Internal Revenue Code Provides That If The Liability Of The Taxpayer Arises Out Of The Provision Of Services To The Taxpayer By Another Person (For Example, An.

Economic performance has occurred with respect to the liability (regs.

A Taxpayer May Elect To Accrue Real Property Taxes Ratably In Accordance With Section 461 (C) And This Paragraph Without The Consent Of The Commissioner For His First Taxable Year.

Section 461 (h) of the internal revenue code provides that if the liability of the taxpayer arises out of the provision of services to the taxpayer by another person (for example, an.